Children are expensive; there’s no denying that fact. And one of the major challenges of coparenting can be keeping track of all of the miscellaneous expenses that are involved and making sure that you are able to share that information with the other parent and make sure everything gets paid. If you’re confused on what expenses are considered shared expenses, aren’t sure when or how you need to notify the other parent of an expense, or are having trouble keeping track of everything, we’ve got the answers and some tools to help.

Types of Shared Expenses

When you’re trying to figure out what expenses are considered shared expenses, the first thing to do is to consult your custody agreement. How shared expenses are supposed to be handled is usually listed in those documents. A few of the most common types of shared expenses are covered below:

- Medical expenses: Medical expenses are the most common type of shared expense in a copareting situation, and this is one that is almost always listed in either the custody agreement or the child support documents. In many cases, these expenses are split 50/50, but if there is a large income disparity the order may specify a different percentage, such as 80/20. These expenses are usually paid for by the primary residential parent, and then, the other parent has to reimburse the residential parent for their portion.

- Dental expenses: These are sometimes covered under the umbrella of medical expenses, but certain dental expenses such as orthodontia are handled separately.

- Extracurriculars: Things like gymnastics lessons, summer camp, school sports fees, and sports uniform costs all fall under the extracurricular umbrella. Extracurriculars are usually not specifically mentioned in court documents and are addressed via agreement by the two parents. In some cases, this may mean reimbursing one parent, but sometimes, both parents are able to just pay their portion directly to the provider.

- Private school tuition: If the children are already attending a private school before the divorce, this will likely be included in the custody documents as to how the expense will be paid for in the future. If you decide to put your children in private school after the divorce, it’s a good idea to put how the expense will be divided added into the official paperwork because this is usually tens of thousands of dollars over the course of their education.

- School supplies, clothes, and other miscellaneous expenses: These smaller expenses are ones that parents often don’t think about when going through the divorce process, but they can add up over time. Most of these expenses will be ones that you work out an agreement on who will pay what or what portion with the other parent.

In general, only things that are specifically listed in your custody documents as shared expenses will qualify in a court setting. You may still be able to agree with the other parent that you will split some things, but if they change their minds or don’t pay you back for something, it’s generally not enforceable in court unless it’s an expense covered in the order.

Guidelines for Notifying the Other Parent

In a coparenting situation, there are often times when only one parent is present for a situation that creates an expense. For example, if the residential parent has to take the child to urgent care for an illness, the other parent may not be able to be present and will need to be notified after the fact. How and when you need to notify the other parent of shared expenses might be outlined in your court documents, but if not, here are some possible options:

- Immediate: If you have a very good coparenting relationship with easy communication and agreement, it may make the most sense to just immediately let the other parent know about an expense so they can reimburse you or pay their part directly as soon as possible. However, this can create a lot of back and forth, especially in the case of multiple children.

- Monthly: Some parents prefer to cover expenses on a monthly basis. They may meet to present receipts and reconcile who owes who what after everything is calculated for the month. This also may make it easier for both parents to pay their parts of extracurricular fees or classes directly to the provider when the monthly bill is due.

- Quarterly: If you don’t have great communication with the other parent and have the finances to be able to wait for reimbursement, a quarterly settlement may be a good option. You can either submit expenses as they come in or all at once at the end of the quarter, and then, the other parent usually has a certain amount of time to repay.

Another thing to consider when thinking about how and when to notify the other parent is how to present receipts. It’s generally best to submit photocopies of detailed receipts that include which child the expense was for, how much it was, who it was paid to and the date. This ensures that the other parent has everything they need to repay you or to pay the provider directly, and it also ensures you have documentation of the expense if you need to present it to the courts.

Simplifying Shared Expenses

Once you know what expenses you should be sharing with the other parent and how often you’re going to be dealing with receipts and reimbursements, it’s time to work on your method. While physical copies and checks can give you a paper trail, it’s also hard to keep track of everything and know what has been paid and what hasn’t at a glance. This is where a tool like 2houses comes in.

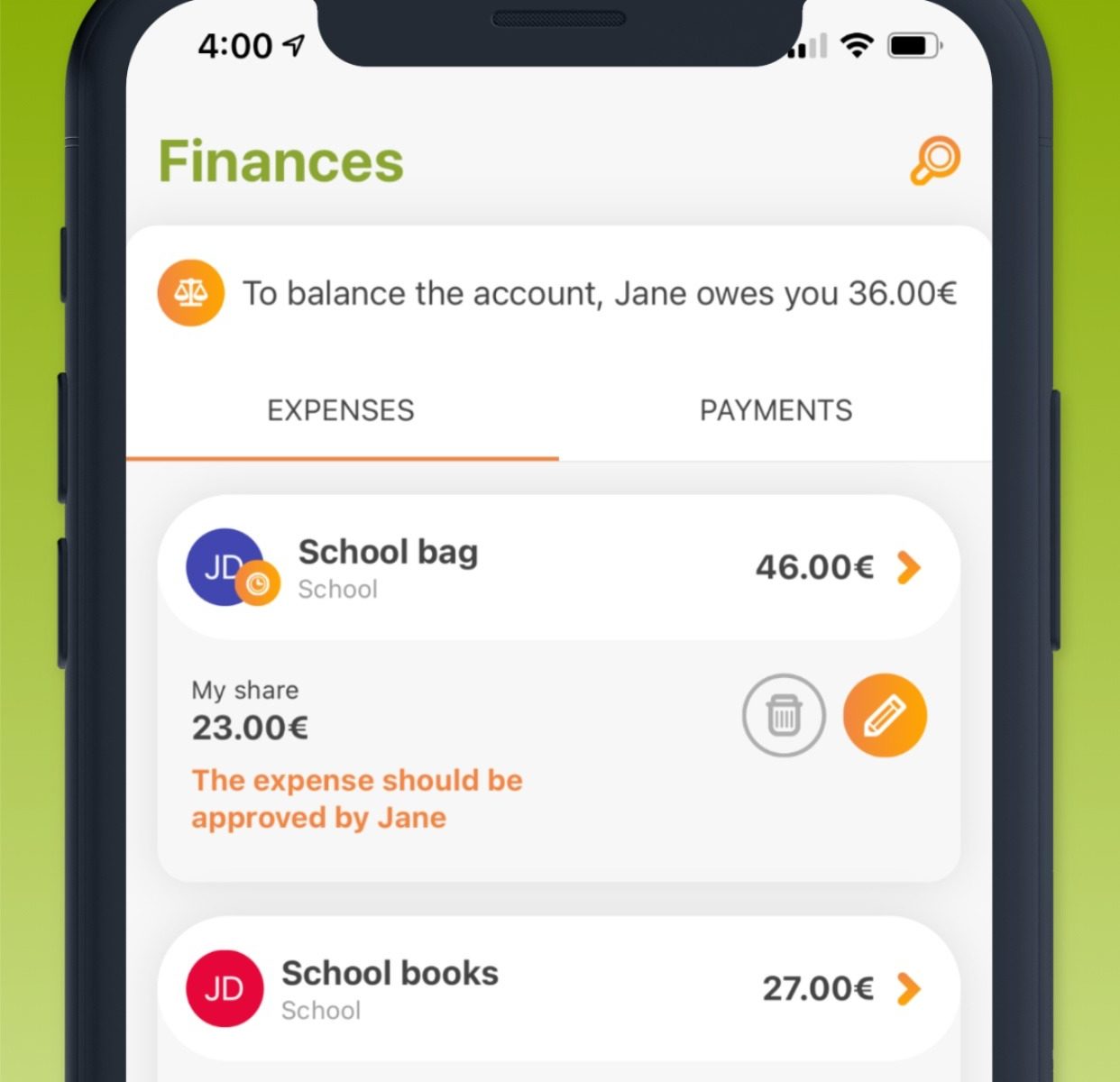

2houses’ finance tool was designed to give you all of the information you need in an easy-to-read manner, and it lets you handle everything from reimbursement requests to payments all within the app. It also has a variety of reporting tools either parent can use to break down expenses by things like category or time period. Here are just a few of the ways using a coparenting app like 2houses can help:

- At-a-glance balance management: The app is set up so that you can see a balance summary at any time. This makes it easy for either parent to always know what’s been paid and what’s outstanding without having to go back and forth with the other parent.

- In-app payments: 2houses has the capability for payments to be registered in the app. This ensures that the balance is always correct and you don’t have to update anything when payments come in, and it also provides a record of payment if needed.

- Wishlist feature: If you and the other parent are splitting expenses like birthday gifts or new clothes, the wishlist feature makes it easy to suggest what your child might want or need. This also comes in handy for the other parent’s side of the family if they need gift ideas or suggestions.

- The ability to categorize expenses: You can tag expenses to be within certain categories, so it’s immediately clear what the money was spent for. This can also help you budget moving forward for recurring expenses. For example, if you are able to see that you usually have about $1,000 in medical expenses per child per year, this makes it easier for both parents to be able to see that and budget for their portion.

- Exporting capabilities: While it can be helpful to have everything online where you can access it from any device, there may be times when you need paper copies. An example of this is when you need to show the courts or the child support enforcement agency proof of expenses. 2houses lets you do both CSV and PDF exports for flexibility.

Whether you’re just starting your coparenting journey and trying to make it as easy as possible or are trying to streamline expenses and communication after a few years, 2houses’ coparenting app and finance tracker can help. The key to successful coparenting is open and frequent communication, but being able to access everything with just a few clicks makes a big difference in ensuring that expenses are reported and reimbursed quickly.